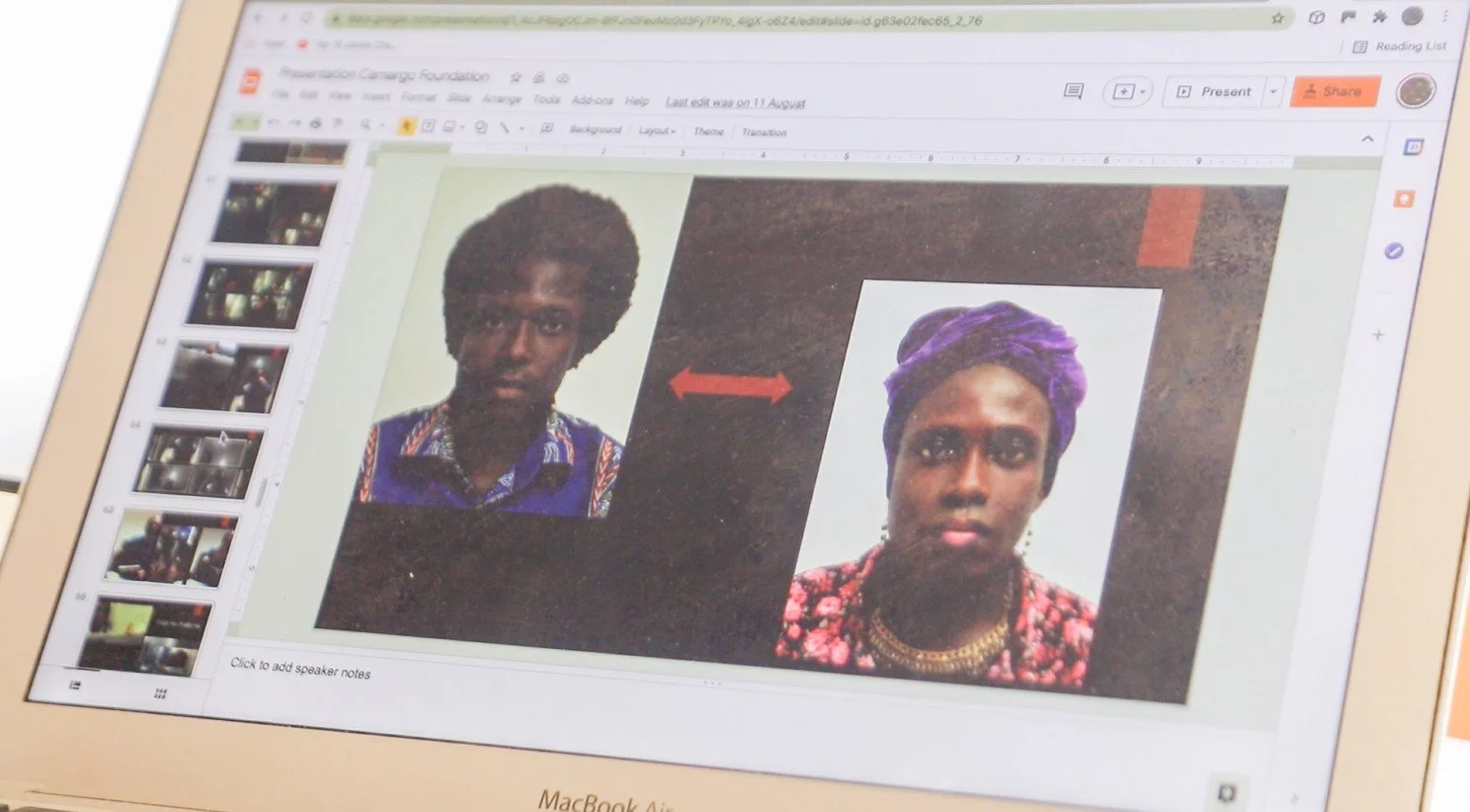

THE HUMAN IMPACT OF ID EXCLUSION

Photo by Edem Robby Abbequaye

“THE LACK OF DIVERSITY AND INCLUSION IN IDENTITY SYSTEMS AND HOW THAT AFFECTS ACCESS TO EVEN BASIC FINANCIAL SERVICES IS A WIDELY DISCUSSED PROBLEM, BUT THE ACTUAL HUMAN IMPACT IS OFTEN FAR LESS WELL UNDERSTOOD. THIS WORK HIGHLIGHTS THE STORIES AND STRUGGLES OF THOSE WHO HAVE FACED EXCLUSION FIRSTHAND.”

Women in Identity are developing an International Identity Code of Conduct, and have been working with ourselves and Caribou Digital to make the case that the ID industry needs a code of conduct to increase inclusion within financial services and products.

Across the world, financial systems are becoming increasingly innovative in how they deliver services to their users. In the digital world, access to and use of these services is changing such as online banking, mobile money, and government services. Verifying identity is central to this to avoid criminal activity, and whilst access to financial services should be a human right, many are still excluded from the system.

Often those excluded are among the most vulnerable in society, including but not restricted to women.

When any new system is designed for a large number of people to use there will always be aspects of it that need improving. Some of the improvements will be unforeseen, but there are also avoidable issues deeply embedded in the design process.

Is the team designing the service or product thinking inclusively from the get go? Have the people making the systems reflected on their own biases? Does the team have a broad mix of experience and backgrounds that reflect society? And so on…

A code of conduct is needed to protect against avoidable and inadvertent biases making their way into the design process and as a result adversely impacting people personally and also in the context of their wider lives.

To help better understand the challenges people who are excluded face we have to see and hear how they experience the systems that they are excluded from.

In order to uncover the causes and impacts of exclusion, we spent time with 10 end users and 5 experts in both the UK and Ghana. Our partner in Ghana was trained journalist and filmmaker Edem Robby Abbeyquaye, who conducted the interviews with the users in Ghana, whilst we led the research in the UK. The expert interviews were conducted by Caribou Digital over zoom. We then coded these interviews to draw out themes and build our understanding of exclusion within this industry.

With the users, we discussed their identities and their experiences of exclusion, as well as their interactions with financial institutions, payments and trust. We also asked for their advice to these institutions to understand how they feel services can increase inclusion.

In turn, Caribou Digital asked 10 experts including the likes of HSBC in the UK and the National Identification Authority in Ghana, about:

product design

exclusion and inclusion,

benefits

harms and workarounds

diversity within teams

Caribou Digital also asked whether they had a code of conduct in place, and what a possible code of conduct would ideally look like.

We produced nine films to accompany the report written by Dr. Savita Bailur and Dr. Emrys Shoemaker from Caribou Digital, edited by Emma Lindley MBE, Dr. Louise Maynard-Atem and Dr. Sarah Walton from Women in Identity.

Furthermore, we uncovered reasons for exclusion, including lack of breeder IDs (supporting identification), lack of proof of address, lack of finances and changes in legislation.

From the joint research, coding and thematic analysis Caribou Digital and us were able to establish five key principles that are foundational to building a code of conduct:

The user is at the centre of an ID ecosystem (not just one, but many ID systems).

Social norms are changing and we need to acknowledge these—“one size does not fit all.”

We need to move towards proportionality, vouching, tiered KYC, and e-KYC (drawing from other government data) to reduce the burden of identity on the user.

Identification may be individual but we live in networks of people that already know us —we need to account better for delegated authorities and intermediaries.

It is essential to build diversity in ID or ID-based design and development teams.

The visual content we produced is being distributed on Women in Identity’s online channels, showcasing the issues that we collaboratively uncovered about exclusion within financial systems.

The Team

Women in Identity is an international non-profit organisation, who drives the digital identity industry to build solutions with diverse teams to promote universal access which enables civic, social and economic empowerment around the world.

Caribou Digital is a research and advisory firm that strives to create a more just, inclusive and ethical digital world.

Habitus Insight is a multimedia research and production collective, we tell stories about an ever changing world and the human experience.